AI Voice Agents for Financial Services: Secure, Compliant, Always On

Pod answers client calls, verifies identities, and manages transactions—delivering seamless support and freeing your staff for complex needs.

See how much time

Pod can save you

Meet the future of banking & lending

Every financial call, handled securely

See how Pod handles every type of financial interaction. From account inquiries to loan processing and compliance verification.

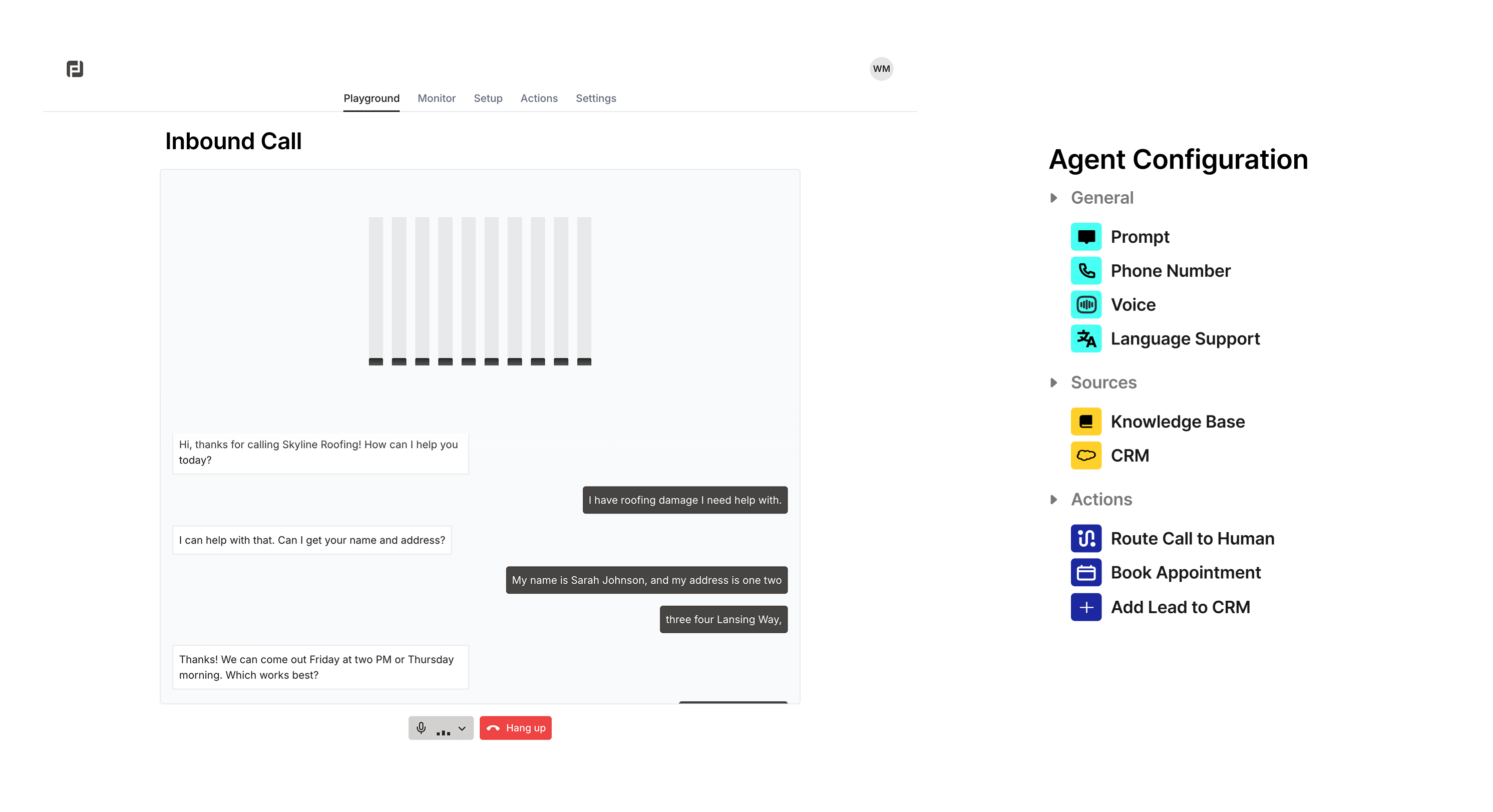

Connect Pod to everything

Pod connects your AI phone agent to all your existing financial systems, knowledge bases, and software. Your AI agent has access to everything your team does, ensuring secure and compliant operations.

Connect to your CRM, calendar, and databases

Pod Integrations give your AI agent real-time access to customer data, appointments, and business information

Access your knowledge base and documentation

Pod Knowledge connects your AI to all your FAQs, policies, and procedures instantly

Integrate with your existing phone system

Pod Phone works with your current phone infrastructure—no rip and replace required

Connect to your business software and APIs

Pod APIs let your AI agent interact with any system your team uses daily

Scale quickly. Stay in control.

Pod's AI voice agents automate routine inquiries, payment processing, and customer support, allowing your team to focus on complex financial services and client relationships.

Setup & deploy your agent

Configure Pod with your business data and deploy to start handling calls.

Agent handles customer calls

Pod answers calls 24/7, understands customer needs, and provides intelligent responses.

Refine & optimize

Monitor performance, review call analytics, and continuously improve your AI agent's responses.

Route complex issues to a human

When needed, Pod seamlessly transfers calls to your team for complex issues requiring human touch.

Your phone agent is ready!

Your financial data is safe with us

Bank-level encryption and security protocols protect your AI conversations and sensitive financial data.

Book a call with our teamFinancial Data & Transaction Security

- PCI DSS and SOC 2 Type 2 compliant encryption

- Protect client accounts and transaction data

- Compliance with banking and lending regulations

Client Data Control

- Full control over client account and loan data

- Secure integration with banking systems

- Client data retention and compliance policies

Multi-Branch Security

- Manage permissions across branch locations

- Control access to sensitive account information

- Role-based security for banking teams

Ready to transform your financial customer calls?

Join companies using Pod to modernize their financial services with AI that handles every transaction, every inquiry, and every client need securely.